Spend Management

for businesses on your platform

for businesses on your platform

Save time and money for your users with a single API call. Introduce a new revenue stream with no financial downside - CapitalOS provides the capital and takes on compliance and risk.

Managing spend is a big problem for

small businesses

79

%

of small businesses rank working capital as their #1 problem

20

Days

wasted annually by small businesses on manual expense

reconciliation

Based on a survey of 2,000 small businesses conducted with our

partners

With

one single API call

curl-XPOST

'https://api.capitalos.com/accounts/:accountId/initiate-login'

CapitalOS takes care of

Credit Underwriting

Offer credit limits that

grow with eligible businesses

on your platform, without credit checks.

APPROVED

Credit Limit

$15,000

Working Capital

We provide the capital

so you won't need to raise and manage debt or take on any financial

risk.

Embedded

UX & APIs

UX & APIs

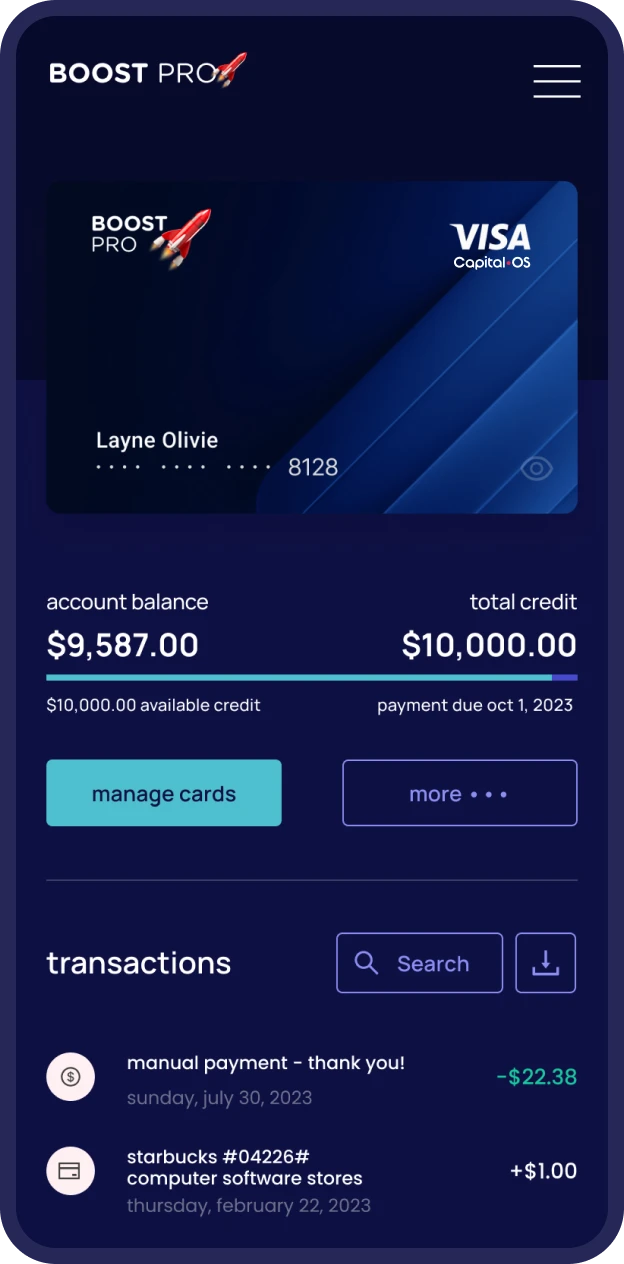

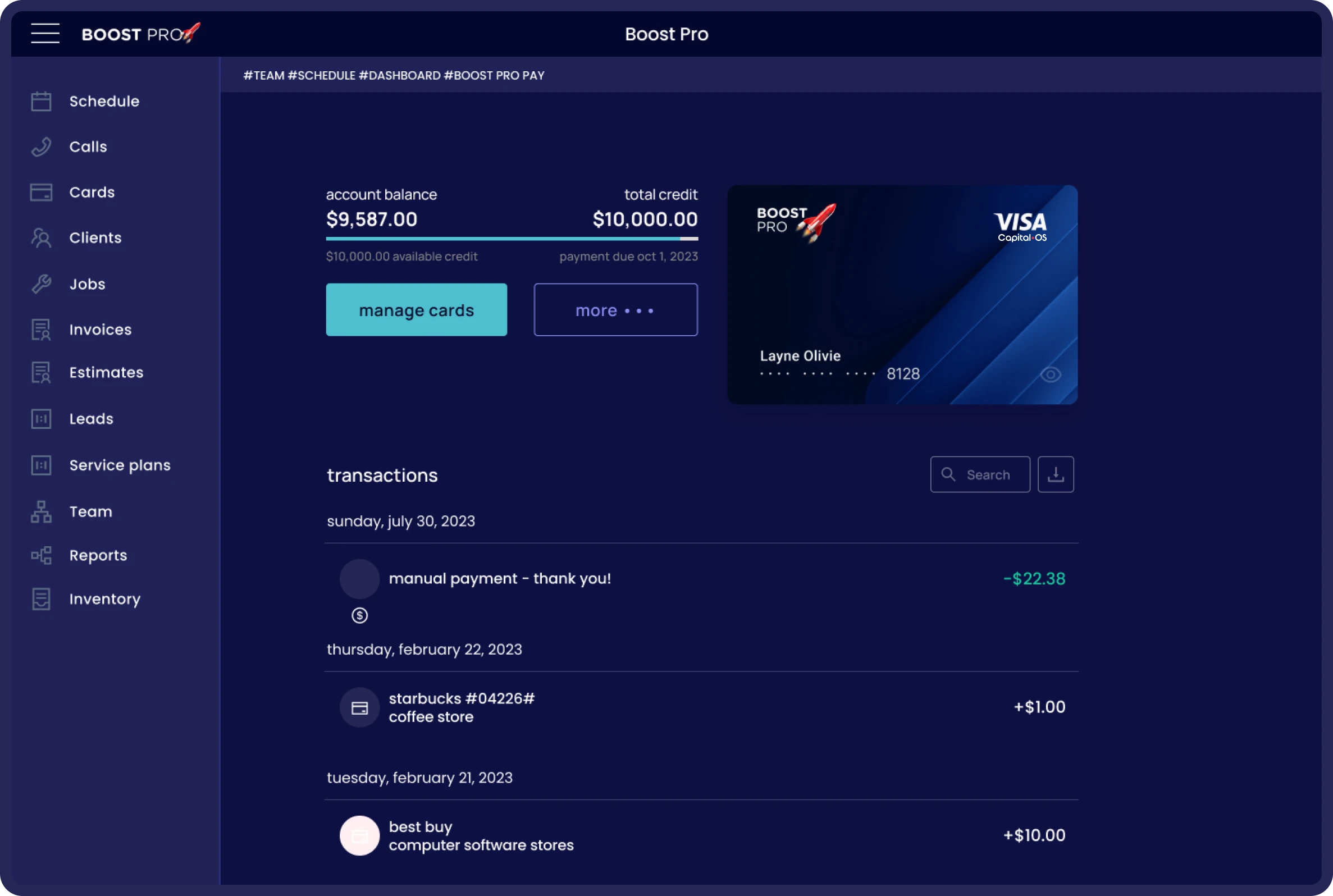

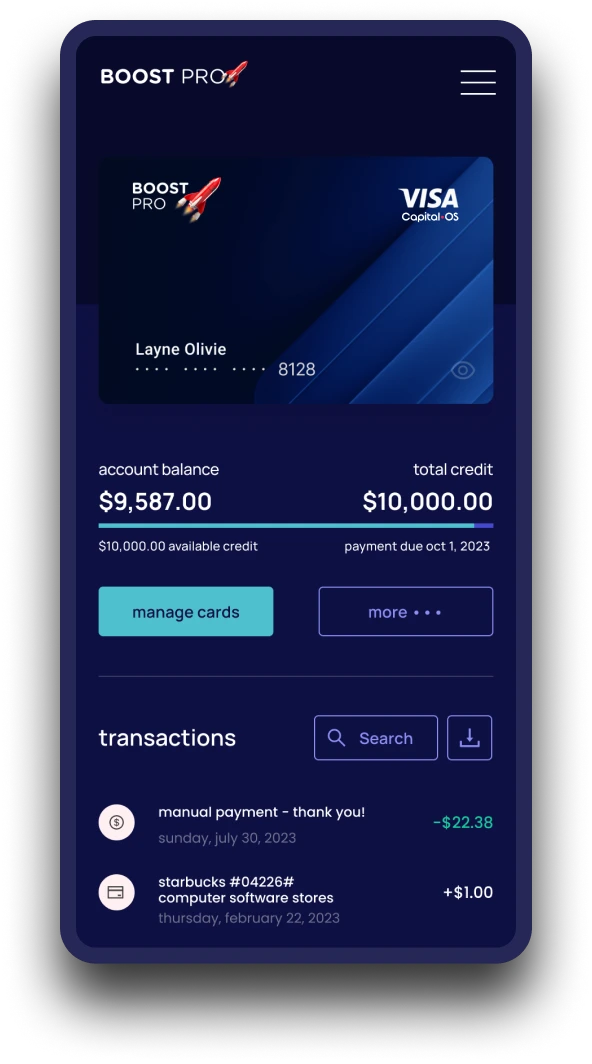

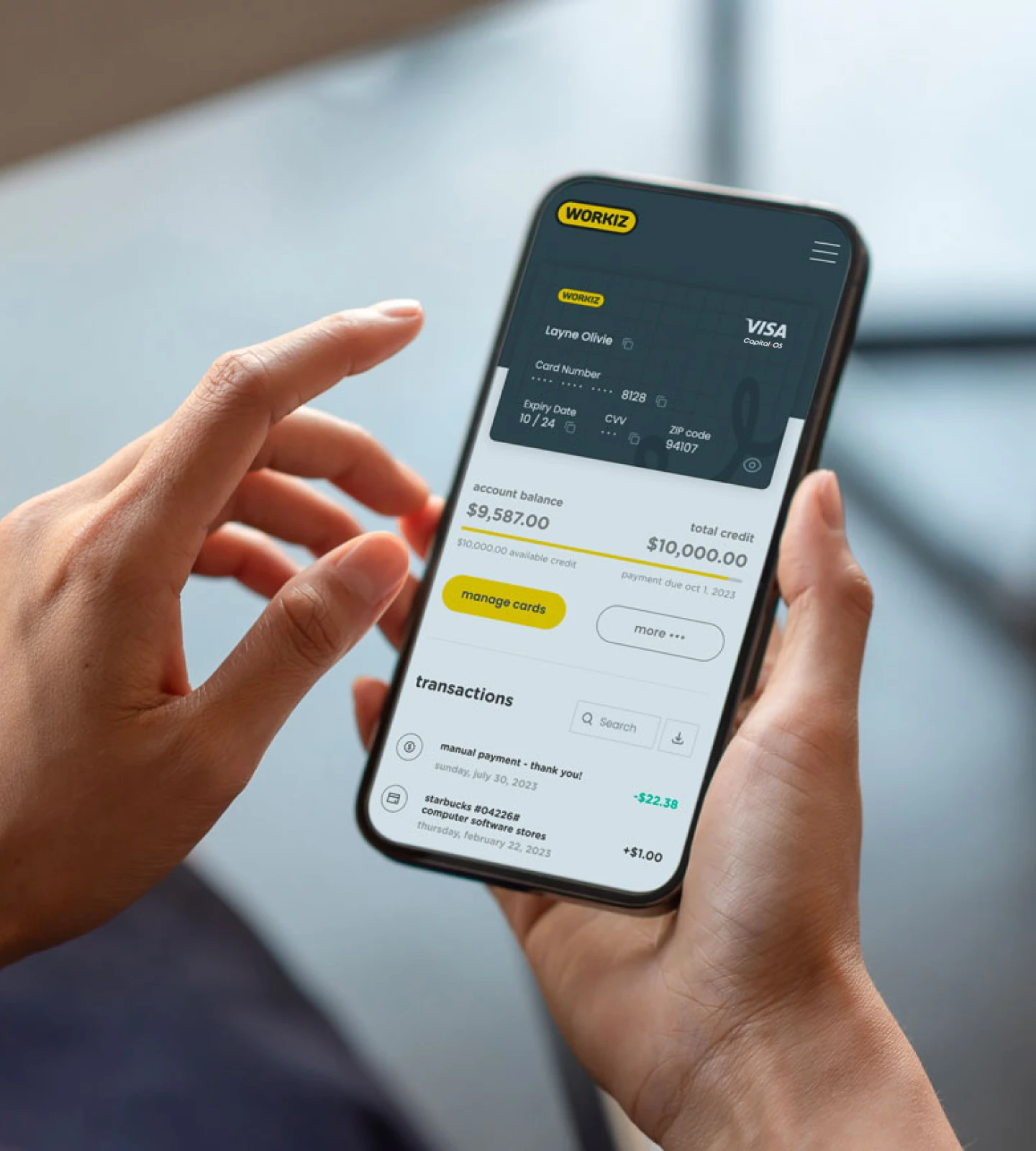

Best-in-class card management

and spend controls that seamlessly integrate into your app

and continuously improve.

Compliance & Licensing

Compliance, auditing, and licensing -

CapitalOS takes on all the heavy lifting so you can focus on your core competency.

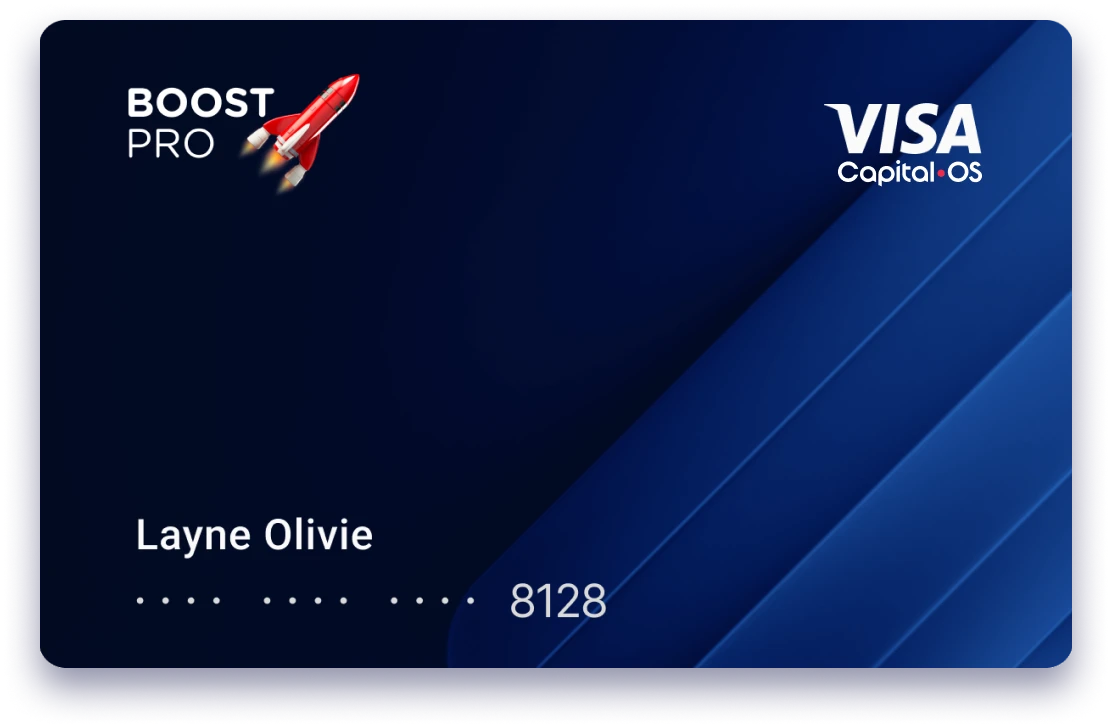

Slick Experience

Most businesses onboard in

2-4 minutes

with instant decisioning. No credit score check. Beautiful

mobile and physical cards.

Fraud & Risk

Delegate risk and fraud to our experts.

Avoid financial risk.

Help your customers

Save money

Save time

Operate efficiently

While driving

A new revenue stream

Increased ARPU

Boosted retention

Workiz

Field Service Management

“Using CapitalOS, we were able to launch Workiz Card to production

in less than a week. Feedback from our users has been phenomenal,

further validating our conviction that managing spend is a big

pain for our customers.“

Yosi Rahimi

VP, Strategy & Operations, Workiz

Roll Credits

Entertainment Production Management

“With CapitalOS's platform, we were able to rapidly implement our

customer card program into our MVP in just a few days - a task

that would have demanded months with any other platform out there.

Their customer support has been exceptionally responsive, setting

a high bar that motivates us to strive for similar excellence in

our own customer interactions.”

Chase Gladish

Co-Founder & CTO at Roll Credits

FAQs

Who provides the underlying capital?

CapitalOS provides the capital and takes on the

underwriting risk. Your platform is not financially

responsible for your businesses' transactions.

What are the sizes of credit limits provided to businesses?

CapitalOS credit limits can vary between 2 to 8 weeks of

the business revenues. Credit limits can reach up to

$100,000/month per business.

Are these cards widely accepted?

CapitalOS cards are accepted wherever Visa is supported.

Who issues CapitalOS cards?

CapitalOS cards are issued by First Internet Bank of

Indiana, Member FDIC, pursuant to a license from Visa Inc.

What are my card design options?

CapitalOS cards are co-branded with your brand. We

will be happy to support you in the design process.

Do you support Apple Wallet and Android Wallet?

Yes! Mobile wallets are fully supported.

Two days to integrate CapitalOS. Seriously?

Yes, we know it's hard to believe! We invested heavily to

make the integration experience extremely simple while

making sure that your product is at the center stage and

we're a hidden provider behind the scenes.

How do I get started?

Contact sales and we will get back to you

as fast as we can.